Taking stock, literally, of the past 30 years of Nebraska football

If college football programs were stocks and you bought some in Nebraska in 1997, well, the ride can't get any rougher than it's already been, right?

It’s just after New Year’s, 1991, and you still believe. Others have their doubts, maybe the most doubt about Tom Osborne and the future of Nebraska football since the late-1970s, when growing dissatisfaction over an inability to beat Oklahoma led Osborne to at least consider a job offer from Colorado.

He stayed, beating the Sooners for the first time in 1978 and winning outright Big Eight titles in 1981, 1982 and 1983. With the option to take a tie and win his first national title in the 1984 Orange Bowl, Osborne did the only brave manlygodly thing and went for two instead. Nebraska finished No. 2 in the AP poll that year, but in the years that followed the Huskers were getting further from, not closer to, the ultimate prize. Nebraska finished fourth in the 1984 AP poll, 11th in 1985, 11th again in 1989 and 24th following the humiliating 45-21 loss to Georgia Tech (huh?) in the 1991 Citrus (isn’t there only Orange?) Bowl.

Nebraska finished the 1990 season with a 20.2 SP+ rating, its lowest since Tom Osborne’s second season (1974) and the second-lowest since 1970.

But you still believe, in Nebraska football and a buy-low investment strategy, so you put your money where your morals are. You purchase 50 shares of Nebraska football stock at the SP+ price of $20.20, a total investment of $1010.

By 1995 your stock, trading at 36.4 over at SP+ following back-to-back national titles, is worth $1,820. Hold or sell? You hold and get another national title out of the deal, though Nebraska’s price dropped to 31.4. Whatever, a $250 hit is worth it for another national title. But now Osborne is riding off into the sunset and you have a real question to answer—still believe or cash out with a $560 profit, each dollar saying, “you were right in 1991”?

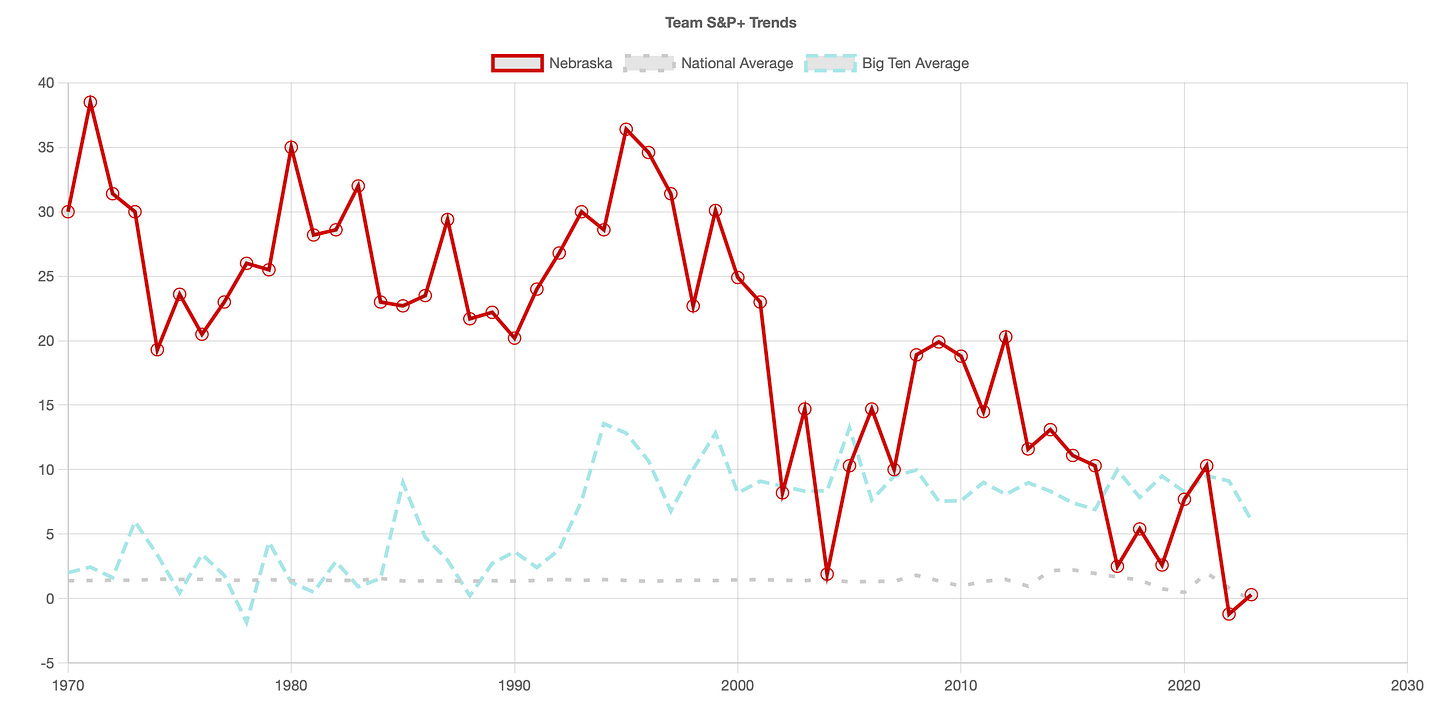

You already have a pretty good idea what happened to those 50 shares of Nebraska football if you’re still holding them in 2024—they went to zero. But I still think there’s value looking at how it was slowly lost.1 As part of the research I did for The Reckoning—a podcast series2 looking at each of Nebraska’s hires post-Osborne—I wanted a consistent baseline for my thoughts. We all know none of the Husker hires worked out as intended, but the program-as-stock approach using SP+ rankings as the price allowed a little more specificity.

Here's how it went down, literally, by coaching era and I’ll do a little comparison to some of Nebraska’s peers over that span as well.

Solich Era

Opening price: 31.4

Closing price: 14.7

50-share value: $735 (down $835, -53%)

Power ratings aren’t everything, of course, but they’re our unit of measure here, and we get a pretty harrowing tale right out of the gate. Frank Solich’s best final SP+ rating of 30.1 was in 1999, barely more than a point off the ’97 national-title team. That mostly tracks for me. That ’99 team was really good, and the difference in overall quality between a team that wins it all and one that doesn’t can be very slim. Per SP+, the ’99 team was a touchdown better than the ’01 team (23.0, 5th nationally) that played for a national title thanks to the BCS computers. Then share prices fell off a cliff, to 8.2 in 2002 with a takeaway-fueled bounce back to 14.7 in 2003. The Huskers only ranked 27th in the final SP+ ratings in 2003—19th in the final AP poll—in part because “get 47 takeaways in 13 games” isn’t really a repeatable strategy. Still, that season should’ve been enough to buy Solich more time, but some of the infamous big-picture concerns then-AD Steve Pederson mentioned when making the decision were showing a bit in Nebraska’s power ratings.

Callahan Era

Opening price: 14.7

Closing price: 10.0

50-share value: $500 (down $235, -32%)

Bill Callahan wasn’t the right hire, as foretold by the fact he was as far as Nebraska got from “first-choice” through any of its hires, but I continue to believe his tenure wasn’t as bad as it is remembered to be. Still doesn’t mean it was good. After an understandable dip in year one of a major scheme switch, Callahan had Nebraska back to where he got it at the end of year three with the ’06 team’s rating (14.7) matching that of ’03. The bottom fell out on the ’07 team as it lost six of its final seven games to finish 5-7. Still, that team’s rating held at a solid 10.0—which is better than a 5-7 record would suggest—so Bo Pelini took over a team that wasn’t just talented based on the recruiting of Callahan’s staff, but one that was perhaps artificially devalued (just a bit).

Pelini Era

Opening Price: 10.0

Closing Price: 13.1

50-share value: $655 (up $155, +31%)

Nebraska made an immediate 8.9-point jump in Pelini’s first season and improved again, by a point, in 2009. The Huskers still wouldn’t hit their high under Pelini for three more seasons, finishing 2012 with a 20.3 rating in SP+, the highest since 2001. That stretch marked the best days at Nebraska since Eric Crouch left, and if Pelini had managed to win one of the three conference titles his teams played for maybe everything that came after comes in a different way. But Nebraska didn’t win those games, the embarrassing 2012 Big Ten title game loss, driving home the point that the Huskers had seemingly hit their ceiling. A loss of SP+ value in 2013 and 2014, despite reaching nine wins both seasons, quietly supported that notion. Yet, Pelini is the only coach post-Osborne3 to have left Nebraska better than he found it by SP+.4

Riley Era

Opening Price: 13.1

Closing Price: 2.5

50-share value: $125 (down $530, -81%)

Prior to this point Nebraska had avoided dropping into the single digits with its SP+ rating since 2002, but the Huskers found a new low in Mike Riley’s third season. His first two, 2015 (11.1) and 2016 (10.3), were virtually indistinguishable from a pure power perspective despite the former ending at 5-7, the latter at 9-4. But unlike Callahan’s final season, Riley’s last one was a true bottoming out to 2.5 as Nebraska stock lost 81% of its value.

Frost Era

Opening Price: 2.5

Closing Price: -1.2

50-share value: $0 (down $125, -100%)

After two blistering, by-the-rebuild-book years at UCF, it was all but assumed Scott Frost could turn around any struggling stock. For most his tenure at his alma mater, it often looked like he was by SP+ even if it never really looked that way on the field. Despite the 0-6 start in 2018 Nebraska had a nice bounce to 5.4 (+116%) in Frost’s first season but couldn’t build on it in year two (-52%). That was the critical juncture given that 2020 was a Covid-dealt wildcard. The 2021 team had the dubious honor of being maybe the best 3-9 team ever, and its SP+ rating showed it climbing to double digits (10.3), the Frost-era high. That was the same final rating the Huskers had in 2005 and 2016, teams that went 8-4 and 9-4 respectively. But that discrepancy between strength and results only served to define the era. After Frost was fired three games into 2022, Nebraska finished the season under interim coach Mickey Joseph and recorded its first negative SP+ rating.

Rhule Year

Opening Price: -1.2

Closing Price: 0.3

50-share value: $15 (up $15)

It’s only one season, and one that included a shocking and disappointing November, but Nebraska’s back in the black! The Huskers had a 7.1 rating in the preseason SP+ for 2024, meaning if Matt Rhule can maintain that through to the end of the season, he’ll have improved Nebraska’s “stock price” 692% in two seasons. But if everything that preceded his arrival in Lincoln taught us anything it’s never to expect anything to go exactly as projected.

What about the other blue-chip stocks?

Entering 1998, Nebraska ranked seventh in all-time winning percentage (.704). It trailed, in order, Notre Dame, Michigan, Alabama, Ohio State, Oklahoma and Texas, and was ahead of USC, Penn State and Tennessee. How did those peer programs’ stock fare since 1997?

Most of them, minus Ohio State, had their ups and downs. Notre Dame dipped somewhat deep into the red (-9.7) in 2007 and Texas (-6.7) and Oklahoma (-7.1) started there in 1997. The only school to avoid an SP+ rating in the single digits over that span is the aforementioned Buckeyes.

While focusing on the start and end of a race ignores a lot of twists and turns along the way, if you’d simply bought some shares of these top-10 college football stocks after the 1997 season and sold them after last season, Texas (+446%) would’ve offered a bumpy ride to the biggest profit among this group, Oklahoma (+311%) provided a more streamlined ride to tripling your money and Alabama (+196%) almost doubled you up thanks to Nick Saban.

Nebraska, no surprise, was the biggest loser in the top 10, but what stands out about the Huskers’ past quarter-century is the gradual erosion of that initial rating. There were occasional peaks and valleys, but the trend was undeniably and continually downward. Which you, a proud stockholder, already knew.

I won’t pretend to know what that means for the future, but for some investors it might be the right time to buy. And for you, who’s already invested, you don’t have a choice. The only place to go from the bottom is up.

Odds & Ends

4-star cornerback Bryson Webber of Missouri City, Texas, committed to Nebraska over the weekend. It’s an encouraging get given Webber’s primary recruiter, defensive backs coach Evan Cooper, left the program earlier this month. Another defensive back recruit went the other way. The Huskers appeared to be at or near the top for 3-star safety Aiden Manutai, but he committed to Cal on Friday.

Nebraska is adding a former Kansas City high school coach to the staff. Jamar Mozee, the head coach at Lee’s Summit North for eight seasons, tweeted that he’s joining the Huskers as a senior football assistant, an off-field coaching role. His son, Isaiah Mozee, is a 4-star receiver in the 2025 class who is currently committed to Oregon.

Grass is coming to Memorial Stadium for 2026, as first reported by Mitch Sherman of The Athletic. I like it aesthetically, and it represents a pretty big investment in something Rhule really wanted, which is an investment in the head coach himself. In one of the first stories we published here, then-AD Trev Alberts told Erin Sorensen that grass was a real possibility. There’s a lot of good info in that story now that we know grass is on the way.

Anyone interested in playing this sort of stock market game for real? Well, not for real money but real pride? In my mind, it works like this: Everyone gets a set budget to invest by buying or selling teams before the season at their preseason SP+ price. From there, wheel and deal all season long as teams’ ratings rise and fall. Person with the most money in their portfolio at the end of the season wins. I think of it like college football nerd fantasy football for people may or may not have (me) been all that into actual fantasy football. Anyway, if you’d have any interest in such a game, let me know in the comments. They’re open to all on this post.

Here’s some symmetry for you: Bob Devaney’s 1972 team ended his final season at 31.4, same as Osborne’s 1997 team.

Acknowledging here that it would’ve been all but impossible for Solich to improve upon the era that preceded him.

Sounds like a fun game. I am not sure how far this next team will succeed but I liked the way both lines improved from the year before. QB play could change what we can do.

I like the game concept. Are the offenses and defenses separate? Or is it one CFL team? i.e. the value of Iowa 's defense is higher than their offense.